Lonza ranks first, and China's WuXi department (WuXi AppTec + WuXi Biologics) has ranked the second position in the world. Among the top 10, two Asian companies and European companies occupy the majority.

| 2021 Global CDMO Ranking Top 10 | ||||

| Rank | Name | Country | Revenue(billions of dollars) | growth rate(%) |

| 1 | Lonza | Switzerland | 4.810 | 12.5% |

| 2 | Wuxi | China | 3.389 | 31.78% |

| 3 | Catalent | USA | 3.094 | 22.9% |

| 4 | FAREVA SA | France | 2.137 | - |

| 5 | Recipharm AB | Sweden | 1.303 | 30% |

| 6 | Samsung Bio | Korea | 1.034 | 14.5% |

| 7 | Delpharm | France | 0.945 | - |

| 8 | Siegfried | Sweden | 0.913 | 1.40% |

| 9 | Boehringer Ingelheim | Germany | 0.905 | 5.6% |

| 10 | Aenova Group | Germany | 0.857 | 0.55% |

In terms of growth rate, WuXi ranks first. In terms of revenue scale, there is still a gap of nearly 1.5 billion US dollars between WuXi and Lonza.

Global CDMO Enterprise Ranking

There are some non-listed companies abroad whose financial data are not regularly disclosed, but their strength cannot be ignored. There are not many CDMO heads in China, and most of them have a revenue of less than 500 million US dollars, and most of them have a revenue of more than 100 million US dollars. There are many outstanding companies among unlisted companies.

Reviews of some foreign companies

From a regional perspective, the European CDMO industry should be the first in the world. We select some featured companies to comment as follows:

In 1897, Lonza was born in the Swiss Alps. So far, the business has spread over three continents around the world. The high-performing team of approximately 14,000 full-time employees, each and every one of them, makes a meaningful difference to business and the region and country in which we operate. In 2020, the company recorded sales of CHF 4.5 billion and earnings before interest, taxes, depreciation and amortization (EBITDA) from the core business of CHF 1.4 billion.

Founded in 1974 and headquartered in Durham, North Carolina, USA and Amsterdam, the Netherlands, Patheon is a leading global provider of outsourced medicines (CDMO), integrating R&D, production, manufacturing and service. Thermo Fisher Scientific acquired Patheon for $7.2 billion in 2017, including $2 billion in net debt. Patheon has advanced production sites in North America and Europe and employs nearly 9,000 people worldwide. The company, which had revenue of about $1.9 billion in 2016, is incorporated into Thermo Fisher's Laboratory Products and Services division.

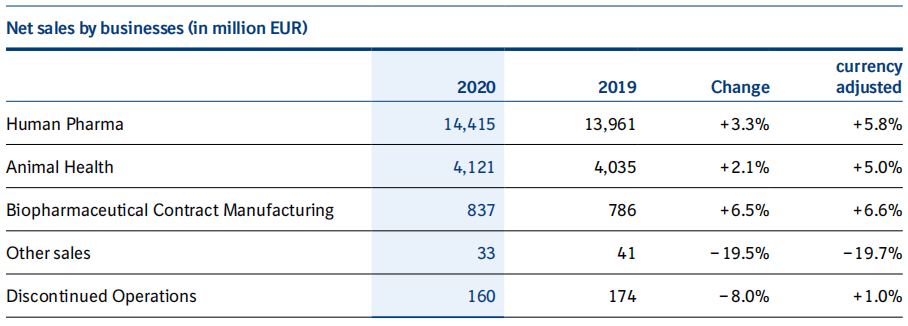

Boehringer Ingelheim was founded in 1885 as a family business. The company's approximately 52,000 employees currently serve more than 130 markets across three business areas: human pharmaceuticals, animal health and biopharmaceutical contract manufacturing. Net sales of pharmaceuticals for human use in 2020 amounted to EUR 14.42 billion, an increase of 5.8% year-on-year (year-on-year growth adjusted for currency changes), accounting for 74% of total net sales, and R&D investment of EUR 3.28 billion, accounting for 22.8% of net sales.

The Animal Health business performed exceptionally well in 2020, growing by 5% year-on-year (year-on-year adjusted for currency changes), with net sales of EUR 4.12 billion. The company completed several acquisitions in 2020 involving veterinary and pet-related companies. The company disclosed that 60% of the top 20 pharmaceutical and innovative biotech companies are customers of Boehringer Ingelheim's CDMO business, which is branded as Boehringer Ingelheim BioXcellenceTM. In 2020, net sales in the Biopharmaceuticals business amounted to EUR 837 million, an increase of 6.6% year-on-year (year-on-year adjusted for currency changes). 2021 Outlook: Boehringer Ingelheim expects comparable net sales to increase slightly year-over-year.

Recipharm is the world's leading pharmaceutical contract development and manufacturing organization (CDMO). Founded in Sweden in 1995, in 2001 the Recipharm brand was established for the growing contract manufacturing segment of the Recip business. Between 2001 and 2007, six additional factories were acquired that added production capacity, new advanced technologies, more diverse dosage forms, and a growing customer network. In 2007, in order to adapt to the changing market, the company decided to fully focus on outsourcing. Development of the 'Recipharm' brand through further acquisitions, establishing a pure CDMO position. From 2015 to 2020, several CDMO companies were successively acquired. In February 2020, Recipharm completed the largest acquisition so far. The acquisition of UK-listed Consort Medical makes Recipharm one of the world's largest CDMOs in terms of revenue. It currently has approximately 30 manufacturing and development facilities in Europe, India, Israel and North America with 8,666 employees.

The Siegfried Group is a global life sciences company with sales of CHF 845.1 million in fiscal 2020 and around 2,500 employees in nine locations on three continents as of December 31, 2020. After taking over two locations in Spain on January 1, 2021, this number increases to around 3,500 employees. Siegfried's business involves the production of APIs and intermediates, as well as the formulation segment (tablets, capsules, sterile vials, ampoules, and salves, etc.), and provides development services. As part of the 2020 acquisition of two large pharmaceutical manufacturing sites from Novartis in Barcelona, Novartis has entered into a long-term manufacturing and supply agreement from which Novartis has committed to purchase significant quantities of important products.

Founded in 1988, Delpharm has 17 factories and 4,700 employees. The company's official website disclosed that its revenue in 2019 was 800 million euros. In 1994, Delpharm acquired the Brétigny plant, Roche Synthex (specialized in solid dosage forms). The company acquired Pfizer Pharmaceutical's Evreux plant in 2002, increasing its solid dosage production capacity. Subsequently, it acquired factories of large multinational pharmaceutical companies such as Bayer, Pfizer, and Sanofi, of which 5 factories were acquired in 2019.

For the fiscal year ended March 31, 2020, Fuji Group's global revenue was $21 billion. FUJIFILM Diosynth Biotechnologies is a biologics contract development and manufacturing organization (CDMO) located in Teesside, UK, RTP, North Carolina, College Station, Texas, and Hillerød, Denmark. FUJIFILM Diosynth Biotechnologies has over 30 years of experience in the development and manufacture of recombinant proteins, vaccines, monoclonal antibodies, macromolecules, viral products and medicinal technologies expressed in a variety of microbial, mammalian and host/viral systems. Tokyo, March 19, 2021 – Fujifilm (President: Sukeno Kenji) announced that it has selected Holly Springs, North Carolina, as its new large-scale cell culture production site in the United States, investing more than $2 billion to build North America’s largest cell culture production site. End-to-end cell culture biopharmaceutical CDMO factory.

Aenova was founded in Germany in 2008 as a merger of drug companies Dragenopharm and Swiss Caps, forming the core of the group. In 2012, the Temmler Group was acquired, and in early 2014 Haupt Pharma was acquired. Aenova has been owned by private equity firm BCPartners since 2012. Aenova Group is a leading global contract manufacturer and development services provider for the pharmaceutical and healthcare industries, including end-to-end delivery of all dosage forms and potency levels, from nutritional solutions to highly active drugs, at 15 locations in Europe and the United States end manufacturing and development with 4,500 employees.

A global, independent and family group founded by Bernard Fraisse in 1990. In 2019, the turnover amounted to 1.81 billion euros, with 12,000 employees in 39 production sites. On December 1, 2020, the Fareva Group has completed the acquisition of two aseptic production sites in Idron and Saint-Julien-en-Genevois, France, from the Pierre-Fabre Group. The acquisition reinforces Fareva's strategy of investing in significant segments of the oncology space to develop and manufacture oncology products.

The Almac Group is an established contract development and manufacturing organization providing a broad range of integrated services to the global pharmaceutical and biotechnology sectors throughout the drug development lifecycle. Services range from R&D, biomarker discovery, development and commercialization, API manufacturing, formulation development, clinical trial supply, IRT (IVRS/IWRS) to commercial scale manufacturing. The international company is privately owned and has grown organically over the past five years and now employs more than 5,600 highly skilled people in 18 factories including Europe, the US and Asia.

Summarize

From the ranking point of view, Chinese companies have indeed entered the forefront of the global ranking, but only one of the WuXi series has entered the top 10. There is a fault in the middle, and most of the remaining domestic CDMO companies are still outside the top 10 or even 100 in the world. In the future, we can rely on the domestic base market to accumulate experience and capital, and actively expand overseas. Like Europe, our CDMO enterprises can also blossom globally.

Pharmaceutical Research CDMO Service Platform

The Medicilon Process Department is deeply involved in the entire industrial chain system of the R&D, procurement and production, from preclinical small-scale synthesis route optimization, process development and scale-up, process validation, quality research to commercial production.

评论

发表评论